Most of the customers, prior to incurring the cost for goods and services, try to get an estimate regarding the approximate amount they will have to pay. In such a situation, a regular GST invoice is not suitable. To help the customers or buyers in such a situation, the seller or client provides them with a proforma invoice.

A proforma invoice format is not to be confused with that of a regular invoice. The key purpose of a proforma invoice is to give the customers a rough estimate of the expenses they will have to make for the said good or services.

The proforma invoice format is constituted of information like time and date of the delivery of the products, the approximate charges to be borne including those name of the sender and the customer to whom the product is sold and various other terms and conditions.

The proforma invoice format before and after the GST remains more or less the same.

Benefits of Proforma Invoice

There are several benefits a proforma invoice provides which you, as a seller, can take advantage of. Some of these benefits are as follows:

Serves As A Binding Agreement Between The Parties

A proforma invoice allows monetary communication between the seller and the buyer. For whatever the goods or services a buyer contacts the seller, the latter fulfills the requisite demand and offers an estimated invoice. It is this estimation which is reflected in the proforma invoice rather than a specified sum which the buyer has to pay.

This establishes a sort of contractual relationship between the parties involved. It also gives the buyer an approximate amount to be paid at the end.

Helpful During Transit Damage

If a commodity or goods gets damaged during transit, the seller usually has to resend it. Along with this, a new invoice is also issued. The process of creating a new invoice can be hectic. With the help of a proforma invoice, the new modifications can be adjusted into it. Thus, it reduces the need for preparing multiple invoices.

Adjusts To Any Changes In The Order

There occur certain situations where the buyers have to make some additions or remove some products from their order. In such a scenario, an already made invoice gets obsolete. To overcome this issue, a proforma invoice is perfect. You can easily bring adjustments to the proforma invoice without needing to recreate a new invoice altogether.

Suitable For Import and Export

For shipping considerations, a proforma serves as a validation for goods or products which are not meant for buying or selling. Products like samples can be easily imported or exported with the help of a proforma invoice. Even for the products to be sold, a proforma invoice can be used at the customs to get a passageway.

Credit For Importation

A proforma invoice generally serves as proof to the bank or other such financial institution to further a letter of credit to the party involved in the importation of the product.

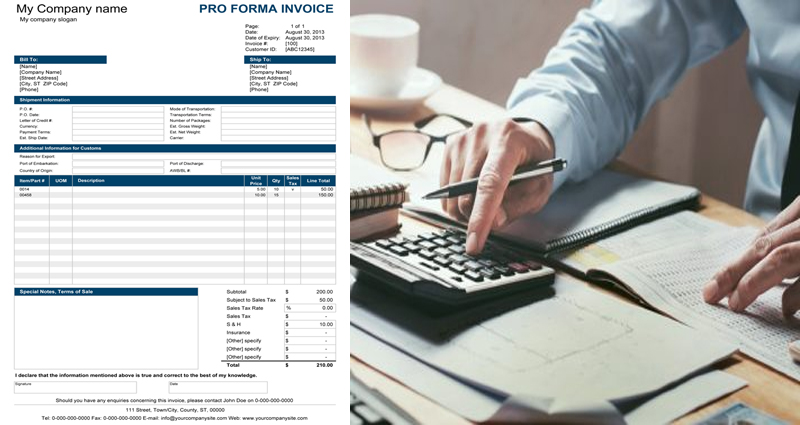

Proforma Invoice Format

A proforma invoice format is relatively simple and involves information pertaining to the transaction to be taking place between a specific buyer and seller. It generally contains:

- Name of the company

- Date of the transaction

- The date at which the proforma invoice is generated.

- List of all the products and services to be sold to a prospective buyer.

- Taxation amount if any.

- The total amount to be paid by the buyer.

- Information pertaining to payment.

A proforma invoice, therefore, can serve both the buyers and sellers simultaneously. Its benefits are to a great extent inclined for the seller as it enables him to keep account of the goods and services provided to a customer. If any adjustments or change of plans take place between the two parties, the proforma invoice format provides the facility of reflecting the same in it.